When Will 280E Stop Hitting the Cannabis Industry?

Understanding Marijuana Rescheduling, President Trump’s Executive Order, and the Tax Reality for Cannabis Businesses

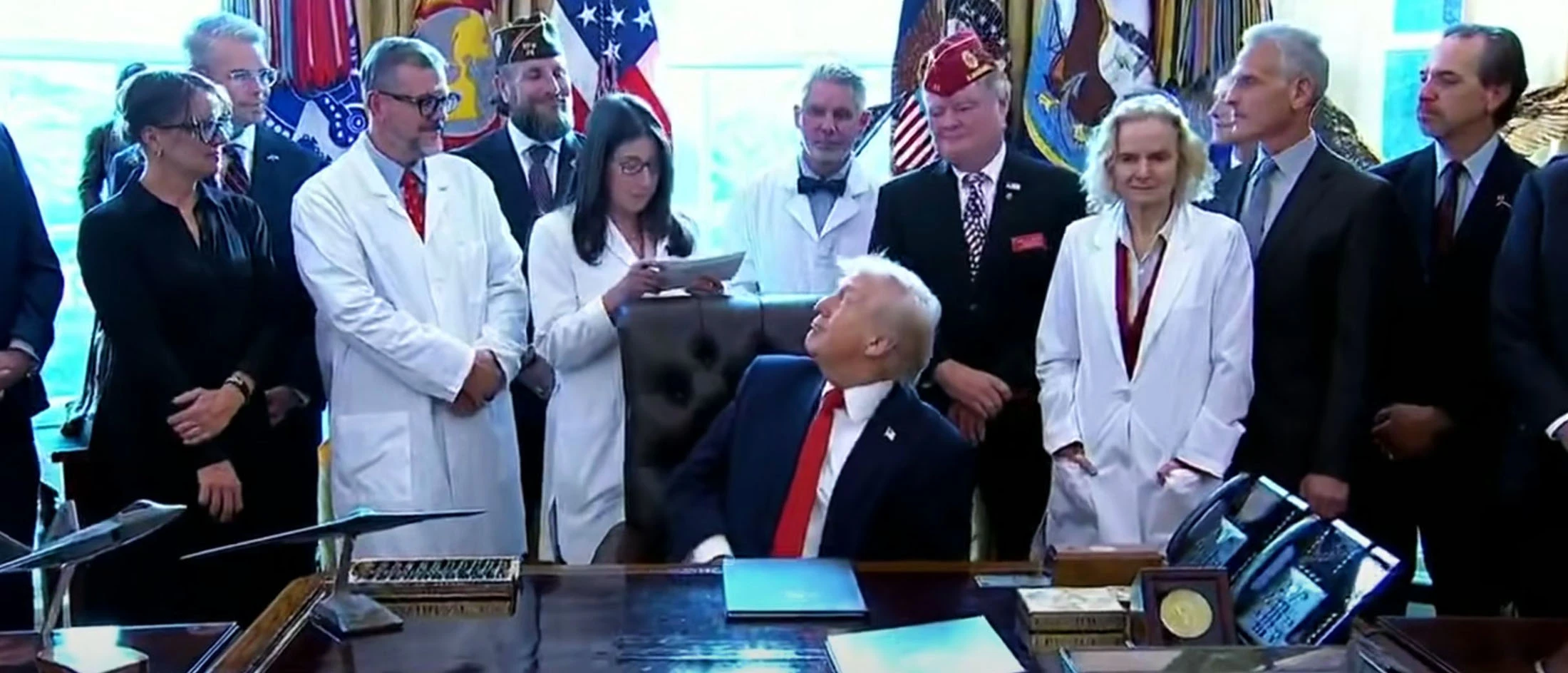

In December 18th 2025, President Donald Trump signed an historical executive order aimed at speeding up the process of reclassifying marijuana under the Controlled Substances Act (CSA). The order tells the Department of Justice and the Drug Enforcement Administration (DEA) to move faster toward changing marijuana from Schedule I to Schedule III—a shift that, if completed, would mark a major change in federal cannabis policy.

Importantly, this move targets medical use and research, not recreational legalization. The executive order’s main goal is to make it easier to study marijuana and use it for recognized medical purposes. Recreational marijuana remains illegal at the federal level, and this order doesn’t change that.

What the Executive Order Does and Doesn’t Do

The order does not immediately reclassify marijuana. Instead, it directs federal agencies to speed up the formal rulemaking process required by the CSA.

- Medical focus: The executive order is designed to reduce barriers for scientific research and medical use.

- Recreational use: It does not legalize recreational marijuana. Federal restrictions on non-medical use remain in place.

Under current law, only a finalized DEA rule—issued after a formal notice-and-comment process with a specific effective date—can change marijuana’s federal scheduling. Until that happens, marijuana stays classified as Schedule I.

Why Schedule III Matters for Taxes

IRS Code Section 280E prevents businesses from deducting normal business expenses if they are trafficking Schedule I or II substances. Because marijuana has long been Schedule I, cannabis operators cannot deduct costs like rent, payroll, marketing, or depreciation—often pushing effective tax rates above 60–80%.

The key point: 280E only applies to Schedule I and II substances. Once marijuana is officially moved to Schedule III, 280E no longer applies.

Timing Is Everything

280E doesn’t go away when:

- The president signs an executive order

- DEA announces it plans to reschedule

- A proposed rule is published

It only stops applying after:

- DEA publishes a final rule moving marijuana to Schedule III, and

- That rule’s effective date takes effect

Income earned after the effective date is eligible for normal deductions. If the rule takes effect mid-year, businesses will have to prorate deductions: revenue earned before the effective date is still subject to 280E.

No Retroactive Relief

Some people think rescheduling could let companies amend past tax returns and reclaim money paid under 280E. That’s unlikely. The IRS applies the law based on the substance’s schedule at the time the income was earned. Retroactive relief would require explicit congressional action, which doesn’t exist.

What Changes and What Doesn’t Change After Schedule III

If marijuana is moved to Schedule III:

What changes:

- Businesses can deduct ordinary expenses

- Effective federal tax rates drop significantly

- Cash flow and valuations improve

- Access to institutional capital becomes easier

What doesn’t change:

- Marijuana is not federally legal for recreational use

- Interstate commerce rules remain strict

- Federal banking challenges continue

- Some states may keep “state-level 280E” rules

Strategic Exits and Pivots: Hemp THC companies face critical decisions — pivot, seek state licenses, or exit.

Monitoring Federal Signals: The president’s speech may influence administrative actions and investor sentiment, even if no immediate reclassification occurs.

Bottom Line

President Trump’s executive order is a step toward speeding up medical and research access to marijuana, however, it does not legalize recreational use at the federal level, even though some states already allow it.. For cannabis businesses, Section 280E only stops applying after DEA rescheduling is finalized and legally effective. Until then, the existing tax rules remain in full force.

Share with